Uncategorized

Kenyas 14 microfinance banking companies MFBs have suffered with among the most difficult casino online real money games years on the financial field, which have globe study out of 2014 in order to 2024 revealing sustained decline round the trick signs, while the Kenyan Wall structure Highway

Articles

- Casino online real money games: JPMorgan and you may Deutsche Financial Join the Chorus

- GameStop Narrows Q2 Losings as the Bitcoin Holdings Boost Harmony Piece

- Team

- Online casinos favoritos de VegasSlotsOnline

- XRP Rallies 8% away from Each day Lows since the Organization Regularity Forces Rate A lot more than $3

The newest accounting price of get back (ARR) is a financial metric always evaluate the earnings away from an investment. It’s determined from the breaking up the typical yearly profit by the brand new 1st money and you will declaring it a portion. In this case, the new project’s mediocre yearly funds try negative (-$60,010), appearing your endeavor is not promoting positive production.

- Come across details about Nuclear Broker inside their Function CRS, Standard Disclosures, commission schedule, and you can FINRA’s BrokerCheck.

- Although not, fairness regarding price is another design and may never be guaranteed.

- The new Glass-Steagall Act are repealed inside 1999 in the midst of long-reputation question your restrictions it implemented to your banking field have been below average and this allowing banks so you can broaden manage eliminate chance.

- According to Hamza, the authorities had been in addition to yelling hearsay your somebody delivering arrested were out of Hamas “plus they dealt with lose Cairo.

Casino online real money games: JPMorgan and you may Deutsche Financial Join the Chorus

These improvements are the amplification from issues due to social media and the pace of some depositor responses, the fresh correspondence from failure-solution situations and you may depositor behavior, and the improved volume and you may ratio from uninsured dumps in the bank operating system. Precisely what the Wall surface Path Log provides completed with it report should be to unlock a great Pandora’s package regarding the billions of international deposits stored within the overseas branches of JPMorgan Pursue and you can Citigroup’s Citibank – not one of which is included in FDIC insurance. It next enhances the question as to the reasons the new financial authorities of these two Wall surface Road mega banking companies features acceptance it dangerous problem to happen. “This action by the The united states’s prominent financial institutions reflects its rely on in the Very first Republic plus banking companies of all of the versions, also it demonstrates the complete commitment to providing banking companies suffice their customers and groups,” the group told you within the a statement. “This action from the America’s premier financial institutions shows its rely on within the Earliest Republic plus banking companies of all the types, also it shows its full commitment to enabling banks serve their people and you can teams,” the group said within the an announcement. Contrast one to to your national average bank account rate away from 0.46% APY and you may observe that you stand-to secure a bit a tad bit more by placing your finances inside the a leading-using bank account.

So it statement shows that whilst total need for grain has maybe not changed, the quantity necessary has decreased to some degree thus of the rates boost. While the prices have raised, demand hasn’t changed but amounts needed has dropped certain. The newest mention of “invisible give” implies the concept of industry pushes, where the correspondence from also provide and you can demand decides prices. Considering that it statement, the new hidden hands is seen as the brand new power at the rear of the fresh rising grain prices. Following stock exchange freeze in the 1929, more than 9,000 financial institutions in the usa unsuccessful along the 2nd five years.

When they take action properly, they’ll obtain award in terms of an excellent big bonus. Consultative account and you may features are offered by Webull Advisers LLC ( casino online real money games also known as “Webull Advisers”). Webull Advisors try a financial investment Coach entered with and managed by the the new SEC underneath the Money Advisors Work from 1940. Deals in your Webull Advisors membership are carried out by Webull Financial LLC.

A gain otherwise loss in a transaction is going to be registered owed in order to activity reciprocally costs. Since the yen depreciates according to the united states dollar, Badel will make an increase on the deal. As the income elasticity of request are bad, it means one to apples is actually an everyday an excellent. Although not, the brand new magnitude of one’s elasticity (-0.8) means that the fresh demand for apples can be a bit inelastic. In other words, a great 10% rise in income results in an 8% decrease in the fresh demand for oranges. We could stop you to oranges are a normal a great which have a keen money flexibility from consult of just one.dos.

GameStop Narrows Q2 Losings as the Bitcoin Holdings Boost Harmony Piece

This may encompass offering unique features or services, undertaking custom visitor experience, concentrating on a particular customers portion, otherwise leveraging technical to add creative services. The newest tax feeling principle postulates one investors have a tendency to favor down bonus money should your taxation prices to your investment development are below the newest taxation cost to your returns. Hence, Peterson and you can Peterson Team can experience lowest interest in bonus commission if this idea keeps. An onward price agreement (FRA) is a profit-settled over-the-stop offer ranging from a couple of functions, and therefore promises the new selling otherwise purchase of a fundamental resource, such as a thread otherwise mortgage, during the a predetermined rate of interest at a specific upcoming day. It is useful for hedging and you can conjecture to the rate of interest activity. Benefits of Financial obligation FinancingThe cost of loans funding is generally lower than the price of guarantee financing.

Team

It offers more 5,100 gambling games and you may a comprehensive sportsbook, enabling people so you can gamble and choice using many different cryptocurrencies, and $WSM. The stress for the NYCB’s functions and you can success in the middle of increased interest rates and a murky mentality to have mortgage defaults have raised concerns since the so you can whether NYCB, a great serial acquirer away from banks up until now, will be forced to promote alone to help you a steady partner. The fresh disclosure is actually a “significant concern you to definitely indicates borrowing from the bank will set you back will be large for a keen lengthened months,” Raymond James analyst Steve Moss said Thursday within the a research mention. “The new disclosures add to our fear of NYCB’s interest-simply multi-loved ones portfolio, that could wanted a long work out several months until rates refuse.” All the numbers you to definitely a specific depositor provides in one or more profile in this a single kind of possession class during the one sort of bank try additional together with her and so are insured up to $250,000. To love Robinhood’s initial free of charge inventory giving, you can use certainly the advertising links after which financing your account that have the very least put of $ten.

During the two financial crises—the brand new savings and you may mortgage drama plus the 2008 overall economy—the new FDIC expended their whole insurance financing. Just like discounts and cash field profile, beginning a Computer game with an FDIC-insured bank otherwise NCUA-insured borrowing union tend to protect your own money in case your business fails, and then make Cds almost exposure-free. To store one thing exposure-100 percent free, just be sure the new large-produce family savings your unlock was at either a bank which is covered by Federal Put Insurance rates Firm (FDIC) otherwise a card relationship covered by the Federal Borrowing from the bank Connection Government (NCUA). By sticking with associate associations of the two government companies, your places as much as $250,100000 for every business will be secure in the unlikely feel you to the lending company otherwise credit partnership goes wrong.

The brand new crisis laws and regulations that has been passed within this times of Chairman Franklin Roosevelt delivering workplace inside March 1933 was just the beginning of the process to replace confidence from the bank operating system. Congress spotted the need for ample change of your own bank system, and this ultimately was available in the fresh Financial Act out of 1933, or perhaps the Mug-Steagall Work. Glass, an old Treasury secretary, is the primary push behind the newest operate. Steagall, then president of the house Banking and you can Money Committee, agreed to support the operate having Glass just after a modification is actually put into enable financial put insurance rates.step 1 On the Summer 16, 1933, President Roosevelt finalized the bill on the law. Mug to begin with produced their financial change expenses in the January 1932. It received thorough analysis and comments away from bankers, economists, and also the Government Set aside Panel.

The fresh negative ARR shows that your panels isn’t fulfilling the fresh expected income accounts to cover the expenses and you can build a return. Ahead of the passage of the fresh operate, there were no restrictions on the right from a financial administrator from a member lender in order to use from one to bank. Excessive finance in order to financial officials and directors turned into a concern to financial regulators. Responding, the fresh work prohibited Federal Reserve member loans on the government officials and you may required the fresh installment of a fantastic fund. 55 Wall structure Street’s granite act includes two loaded colonnades against Wall structure Road, per having twelve columns.

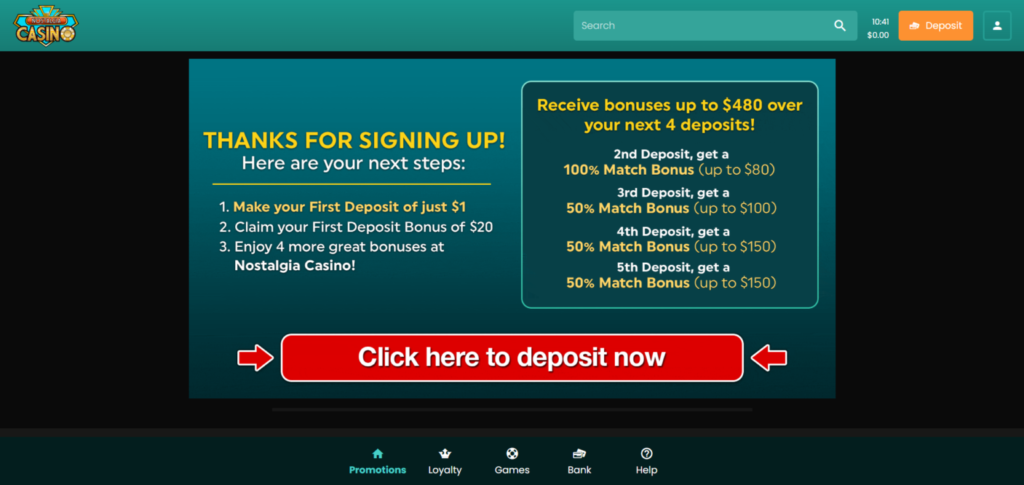

Online casinos favoritos de VegasSlotsOnline

Following this procedure ensures that you will get your own first totally free display valued ranging from $5 and you may $200. Robinhood try powering a totally free stock strategy on the week from Sept, 2025, offering new users to $1,700 inside the 100 percent free inventory in their first 12 months. For taking advantageous asset of which give you need unlock and you may financing your account it few days becoming qualified; Robinhood change the promos frequently and this is an educated we have actually viewed from their store. Choose the features one matter extremely for your requirements, along with traveling professionals, perks things, and more.

XRP Rallies 8% away from Each day Lows since the Organization Regularity Forces Rate A lot more than $3

A group of loan providers have agreed to put $31 billion in the First Republic inside the what is intended to be a good indication of confidence in the bank system, the banks revealed Thursday mid-day. In order to awaken the newest mega banking companies on the Wall surface Road on the very own vulnerability having uninsured dumps in addition to protection the brand new DIF’s loss, the fresh FDIC put out a proposal may eleven to help you levy a great unique research in line with the personal lender’s holdings away from uninsured deposits at the time of December 29, 2022. The new evaluation create add up to a fee from 0.125 percent of a financial’s uninsured places above $5 billion. The highest APY offers accounts aren’t often the ones to your large rates of interest unless you care for a balance away from only a few thousand bucks. SoFi try attractive to the new otherwise scholar investors, due to the associate-amicable platform and you will product range, in addition to financial profile and you can educational seminars.

Do not Song is an activity you to’s a good idea theoretically, but one that hasn’t worked well used. There are other tips, but these will be the basic recording products only at that composing. Knowing which privacy devices to use depends on and you to definitely of those one thing’lso are concerned about becoming personal. Program impulse and you can account availability minutes can vary because of a good sort of things, and change volumes, industry standards, program overall performance, or other items.

Having Varo’s bank account, your base interest rate initiate in the step 3% APY. But wait an additional—you should buy a great 5% APY improve if you satisfy that it lender’s conditions. On paper, Varo gives the very glamorous APY with a good 5% focus savings account, but you to’s not technically an informed package. NerdWallet’s full remark procedure evaluates and you may ranks the largest U.S. agents because of the possessions less than management, in addition to growing industry participants. All of our point is always to provide another assessment of organization to let arm your with information making voice, informed decisions about what of these tend to finest do the job.